AI Agents transform how financial institutions operate by combining autonomy with strategic decision-making. Unlike traditional AI, which primarily analyzes data or generates content, AI agents autonomously take action based on context, objectives, and evolving conditions. This capability makes AI agent use especially valuable in banking, where dynamic processes require both precision and adaptability.

Where banks face challenges in areas such as enhancing decision-making, personalizing customer engagement, and streamlining compliance processes: AI agents help by automating complex workflows and enabling stronger human-AI collaboration.

Adding AI agents into automated business workflows with Flowable fosters fast, data-driven decisions, while keeping humans strategically in the loop. The result is a more agile and efficient work environment that responds to changing customer needs and regulatory demands faster and with more efficiency support for your teams.

Transforming core banking operations with AI agents as efficiency enablers

In modern banking, core operations must be efficient, accurate, and adaptable. AI agents address these needs by automating complex tasks, enabling smarter decision-making, and streamlining data handling. AI agent use cases can transform specific core banking functions.

“Business Logic in the Digital Age: Smarter Automation, Agile Decisions, Scalable Growth!”

AI agent use case: Enhancing investment analysis and credit risk review

Investment analysis often requires time-consuming manual due diligence. Financial institutions spend significant resources evaluating market conditions, assessing risks, and compiling reports. But manually actioning these processes at scale, can wear availability for in depth decision-making thin and increase the risk of human error.

Building AI agents into automated business processes with Flowable speeds up this process by integrating real time market analysis, credit risk assessment, and report generation within your teams’ workflows. This approach accelerates decision-making, cuts costs, and improves transparency while human experts interpret AI-generated data and make final decisions instead of performing straining manual tasks.

An analysis by McKinsey found that multi-agent AI systems in credit memo preparation deliver productivity gains of up to 60% for credit analysts while accelerating decision-making by around 30%.

AI agent use case: Enhancing investment analysis and credit risk review

Investment analysis often requires time-consuming manual due diligence. Financial institutions spend significant resources evaluating market conditions, assessing risks, and compiling reports. But manually actioning these processes at scale, can wear availability for in depth decision-making thin and increase the risk of human error.

Building AI agents into automated business processes with Flowable speeds up this process by integrating real time market analysis, credit risk assessment, and report generation within your teams’ workflows. This approach accelerates decision-making, cuts costs, and improves transparency while human experts interpret AI-generated data and make final decisions instead of performing straining manual tasks.

An analysis by McKinsey found that multi-agent AI systems in credit memo preparation deliver productivity gains of up to 60% for credit analysts while accelerating decision-making by around 30%.

AI agent use case: Personalized customer communication and client lifecycle management

Banks using manual processes often struggle with inconsistent customer interactions that impact efficiency and service quality. These challenges become even more prominent as customer expectations for personalized and responsive service grow. Without a systematic approach, maintaining consistent service quality is a huge task.

Integrating AI agents into workflows with Flowable enables improving customer relationship management by automating personalized communications and recommendations. Customized AI agents can analyze customer data, proactively suggesting relevant products or services.

For example, when customers’ spending patterns change, the responsible agent can suggest tailored financial products, such as savings plans or investment opportunities. Which drastically reduces the workload for employees handling customer lifecycles with support that delivers a consistent, tailored, scalable experience. While humans still handle interactions, they are provided AI agent-driven insights that support deeper, more meaningful engagements.

Driving efficiency with on-team agents at the heart of key banking processes

Modern banking processes require speed, accuracy, and robust security. AI agent integration with Flowable helps financial institutions to super-power compliance checks and fraud detection, while optimizing routine operations.

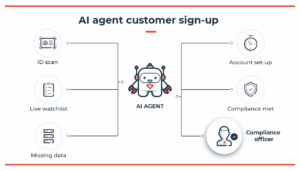

AI agent use case: Securing lightning fast omnichannel customer onboarding with AI-driven KYC

Traditional onboarding tends to be slow and fragmented, often relying on manual know your customer (KYC) checks. With customers opening accounts across channels — using in-branch, mobile app, or online processes — speed can be hard to align, and disconnect frustrates customers and increases operational costs. Delays in tasks like ID verification and compliance checks can further slow the process, impacting customer satisfaction.

Using AI agents, Flowable streamlines this by automating tasks like ID verification, cross-referencing with live watchlists, and flagging risks for human review. A unified onboarding workflow using business process model and notation (BPMN) and case management model notation (CMMN) allows AI agents to verify ID documents using optical character recognition and compare them against watchlists in real time.

By integrating anti-money laundering (AML) verification directly into the workflow, AI agent integration builds faster and more accurate compliance. Compliance officers only need to intervene in exceptional cases, significantly reducing onboarding times and maintaining omni-channel consistency across branches, mobile apps, and websites.

AI agent use case: Optimizing loan origination and underwriting

Loan processing often involves manual data collection and risk evaluation, making it cumbersome and slow. Delays in approvals can lead to customer dissatisfaction and missed business opportunities, and human error during risk evaluation can also result in financial losses.

AI Agents can automate these steps by gathering applicant information, performing preliminary risk scoring, and actioning communication across channels to obtain missing info, generate forms, and for intelligent document storage. Flowable built AI agents are able to gather customer financials, credit scores, and collateral details at speed. If the data meets core criteria, the AI agent moves the process to approval; if not, it directs the application to an underwriter for further review.

This streamlined process reduces processing time and enhances accuracy, leading to better customer experiences. Automated credit scoring ensures consistency, while human oversight guarantees that complex cases receive appropriate attention.

AI agent use case: Enhancing real-time fraud detection and dispute resolution

Banks often face significant challenges relating to fraud detection and dispute handling. Manual investigation of suspicious activities can overwhelm call centers, leading to long response times and potential compliance issues. And as fraudsters become more sophisticated, traditional monitoring methods often fail to keep pace.

AI agents can continuously monitor transactions, identify anomalies, and trigger workflows to investigate potential fraud. BPMN orchestrations enables organizations to pull in transaction data from multiple systems, using real-time pattern recognition to detect suspicious activity.

The system can automatically flag unusual credit card transactions and initiate immediate customer notifications. If the dispute cannot be resolved automatically, it escalates to a specialized resolution officer. Orchestrating AI agent use within Flowable automated processes builds native proactive workflows that not only reduce resolution time but improve customer satisfaction by providing faster, more transparent dispute handling.

There are some tasks that are just perfect matches with the processing power of integrated AI. As The Bank of England noted, AI’s ability to detect financial crime and fraud in real time is one of the key drivers for its transformative impact on the financial system.

AI agent use case: Improving sustainability and ethical investment screening

The increasing focus on environmental, social, and governance (ESG) frameworks, brings with it a need for efficient ways to screen ethical investment opportunities. Traditionally, this process involves gathering data from multiple sources, which can be time-consuming and error prone.

By setting up AI agents within Flowable’s business process automation, agents can collect information from ESG databases and perform initial impact analysis, flagging risks for human validation. This shortens screening times and aligns investment choices with sustainability goals, supporting compliance and ethical standards. Which means investment managers can make quicker decisions without compromising the quality of due diligence.

The future of banking with intelligent agents

AI agents are reshaping banking by aligning human expertise with automated core processes, and an AI agent platform will keep you ahead of the competition today. The ability to analyze data, predict outcomes, and execute decisions makes agentic AI an indispensable tool for modern financial institutions. By leveraging AI, banks achieve greater efficiency, improved customer experiences, and a proactive approach to compliance.

Embracing agentic AI enhances operational efficiency and positions banks to stay ahead in a competitive market. As technology advances, banks integrating AI agents into their core processes will gain a significant edge, offering faster, more personalized, and secure financial services.

The Bank of America predicts that agentic AI will alter bank operations reliant on human capital and spark a corporate efficiency revolution that transforms the global economy. That spark and the synergy between human expertise and AI-driven automation are ushering in a new age of digital banking. Are you ready for it?

Via: flowable